Why I started Earthling VC: Winning in the augmentative era

It’s a historically awful time to raise a new venture fund— I decided to do it anyway.

Why? I felt the window of opportunity for me and our thesis was now and, possibly in a contrarian manner, building a fund during a depressed venture market could be the best time to start building in the grand scheme of things— some of the best fund vintages occurred in the aftermath of market crashes. Nonetheless, it’s the era of the “cockroach” emerging manager: Those able to scrap their Fund I’s and II’s together in this environment, and survive long enough, will lay the successful early foundations of enduring venture firms. While it’s a terrible time to raise, it’s a fantastic time to deploy. Those managers will be battle-tested and pushed to the limit early in their manager careers— but will likely have outstanding fund performance to show for it.

In starting Earthling, I’m betting the house (literally) on a non-consensus prediction for the future that I’m convinced I’m right about. I left my cushy role as an overpaid senior ML engineer at Meta — whose stock, meanwhile, was heavily rebounding when I decided to leave — and pseudo-full-time angel investor to burn my savings to pursue the opportunity to build this venture firm.

In this write-up, I want to lay out why I decided to be opportunistic in starting Earthling now. Specifically, I will cover the huge market opportunity that I quit my engineering career to pursue (the “augmentative era”), the funding landscape of the augmentative era and where the gap is, and why I believe we are best positioned to fill that gap. I hope it’s useful for the thought processes of others noodling on the idea of starting funds today.

TL;DR

The very short form, without the nuances. Read the whole thing for a better story:

We are entering the augmentative era: the new paradigm that makes digital technology feel more human by disbanding the barriers between our perceptions of real and digital worlds. The augmentative era makes computing dynamic, serendipitous, and spatial.

The augmentative era is already here, spearheaded by the $336B gaming ecosystem. Gaming is often the first adopter of new technical breakthroughs, and there is already evidence of adaptation to many other sectors of consumer tech— presenting a generational market opportunity.

Why invest now? The technical tools needed to build the augmentative era (e.g. AI and AR/VR) hit respective inflection points in 2023, sparking a myriad of new start-up innovations and categories of companies that were infeasible last year— and 2023 is only the beginning.

Who’s funding the augmentative era? Big corporates like Nvidia and top funds like a16z, among many others. The problem: With a lack of standardized language to talk about the “augmentative era”, everyone uses a different name or angle to describe it but is investing in the same vision of the future. Most active players are investing seed stage and later.

The funding gap: While a few legendary pre-seed funds invest in the augmentative era, there is a surplus of highly talented teams compared to available venture capital at the earliest stages. Now is the time to start a pre-seed firm: There is demonstrative demand and market for VC capital, and there is enormous long-term upside potential in establishing a leading firm before broader market consensus.

Why us? I’ve spent the entirety of my professional career on the building blocks of the augmentative era, most recently as a senior ML engineer at Meta working on spatial AI, and as an angel investor funding pre-seed augmentative startups. The fund is both a culmination of personal and professional journeys with humble beginnings. Leveraging technical expertise and deep industry networks across VC, corporates, and startups, I’m already been seeing top teams, backing them, and going to war for them to help them grow from pre-seed to seed stage. Market demand began to exceed my personal time and capital, so institutionalizing the fund was the natural step to capture the asymmetric market upside, and fill the aforementioned gap in funding.

Context: WTH does Earthling do?

Earthling is a pre-seed deep tech fund investing in the augmentative era: the paradigm shift that makes digital technology feel more human.

The “non-consensus” opportunity: the augmentative era

Some will agree, but many will not!

We’re entering the augmentative era: digital technology that feels more human.

As a society, we spend countless hours every day in digital mediums— its dasein is a requisite to completing fundamental daily tasks, such as doing our office jobs or communicating with friends and family. Yet, despite its deep functional integration into our lives, our interaction with most tech feels disjointed from our experience in the real world. This should not be surprising; Today, most digital consumer technology is a static, minimally-interactive stream of information devoid of any spontaneity confined into unnatural 2D boxes and buttons— in other words, it is incapable of capturing the very essence of reality in which humans find meaning. Thus, it should also not be surprising that, for example, extensive usage of major consumer tech platforms in this paradigm e.g. social media, the present digital alternatives to in-person interactions, are heavily correlated with feelings of isolation and loneliness.

With Earthling, we’re betting that we’re at the onset of a paradigm shift that finally makes digital technology feel more human: the convergence of digital mediums and the medium of reality, the era of digital tech that augments the human experience. For simplicity, I refer to this new paradigm as the “augmentative era” of digital technology. The augmentative era is intellectually and sensorily immersive, disbanding the barriers between our perceptions of real and digital worlds. The augmentative era is dynamic, serendipitous, and spatial. The augmentative era makes us feel present with ourselves, friends, and family all across the world, and the physical environment around us. Not only does this reshape how we currently work, play, and communicate (for the better), but it also opens up categories of novel digital experiences that were previously infeasible. And we believe that’s a generational market opportunity.

The augmentative era is not science fiction, it’s already here.

The new paradigm has already taken hold of the gaming ecosystem, the world’s largest entertainment market. 3.4B gamers globally (i.e. ~42% of the world’s population) hang out with friends, build communities, and drive digital marketplaces within inherently spatial virtual worlds such as on Roblox, Minecraft, Fortnite, etc. In real-time, evergreen gaming platforms are moving social platforms into virtual worlds where gamers are forging real relationships with real people in environments that emulate the open-ended, unpredictable dynamics of the real world (unlike 2D planes).

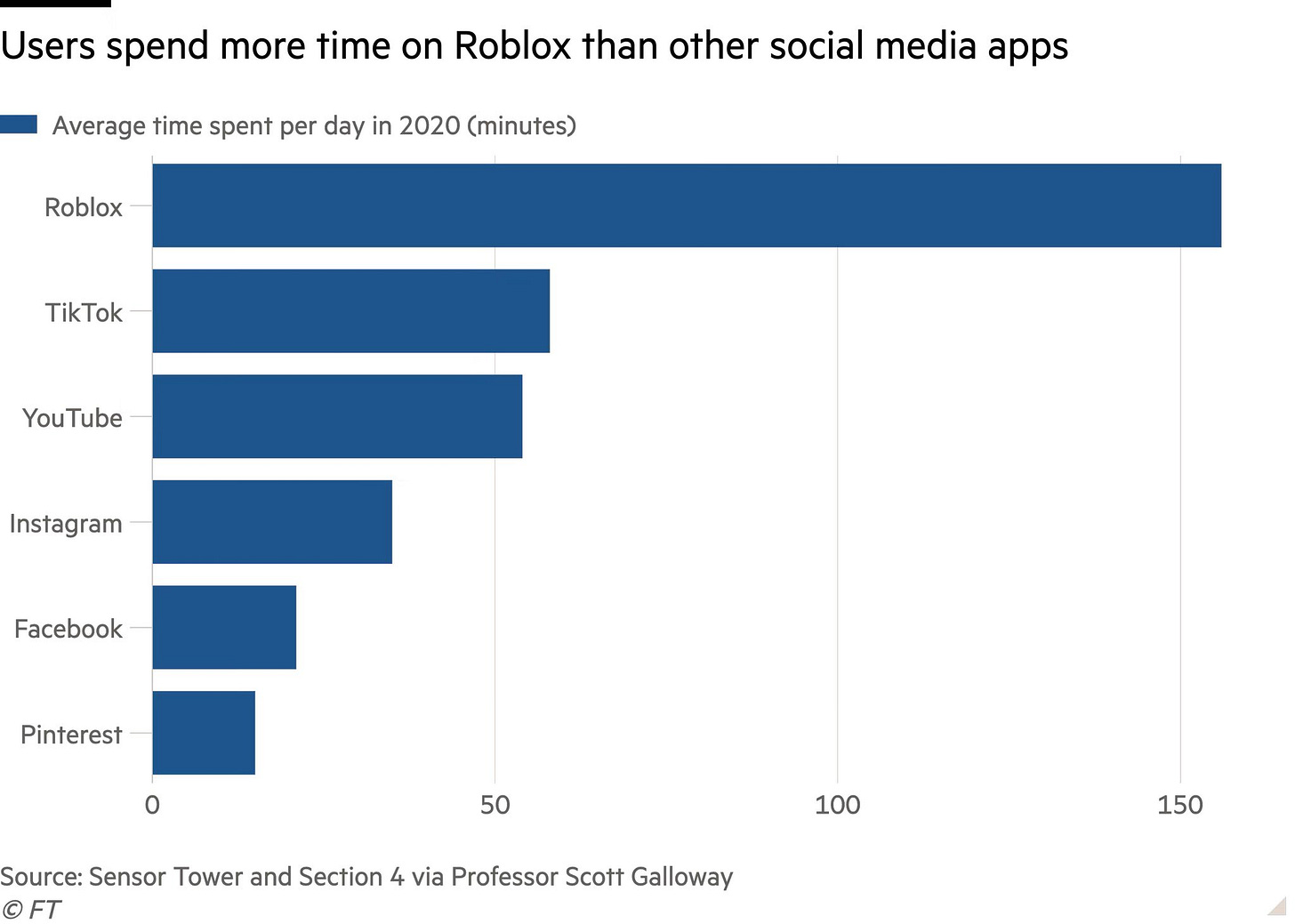

This trend is only likely to accelerate: Roblox is already the most popular social and gaming platform among Gen Z and Gen Alpha, where users are spending significantly more time daily than on old paradigm social media platforms like TikTok or Instagram. And, by the way, this is a positive trend: games encourage creativity, positive communication with peers, and a positive state of mental well-being— a stark contrast to the aforementioned side effects of traditional social media. In contrast to “old” generations, the generations of the future are growing up on social, immersive, and augmentative platforms. We believe these gaming trends are an overwhelmingly positive signal that the proliferation of the augmentative era will drive net-positive societal outcomes building a healthier relationship between humans and computers.

While gaming is the first killer adopter of the new paradigm — which, as a $336B market, itself justifies venture investing today — it’s just the tip of the iceberg. Inevitably, trends first popularized in gaming expand into other domains. At company granularity, giants like Nvidia, Discord, Slack, and many others were founded as gaming-centric companies that later transcended into broader markets. The augmentative era is on the same transcendent trajectory: By 2027 consumers may spend ~4 hours daily in virtual worlds partaking in activities like e-commerce, education, and fitness. We’re already seeing many strong, retentive use cases outside of gaming take in virtual spaces, for example, STEM classes in schools, industrial training, fitness, mental health and therapy, and design processes, just to name a few. By all accounts, we’re only just getting started in 2023.

So with what tools do we build the augmentative era?

Just like the proliferation of cloud computing enabled a new era of startups like Netflix, Spotify, etc. in the late 2000s/early 2010s, innovations in foundational core technologies provide building blocks for startups of the augmentative era to expand use cases. It’s important to remember that these core technologies are the current means, not the ends, to build out the augmentative era, and may evolve or change over time— tech evolves at a rapid pace:

AI is the source of dynamism in digitally augmented environments, leveraging its understanding of humans and their environments to deliver human-like interactions, scenarios, and problem-solving capabilities. AI also assists us in building these interactions and environments at an unprecedented scale required for 3D to be viable.

AR/VR is the spatial window into AI. It enables us to feel a sense of presence and connection in our digitally augmented environments which emulate the sensations of real-world experiences.

Crucially, AI and AR/VR hit respective inflection points in 2023.

Tech conglomerates like Nvidia, Meta, and OpenAI have made explosive advances in base AI models (e.g. LLMs) and infrastructure available to the public, sparking a race to the top in core AI discoveries alongside newcomer research labs like Anthropic, Inflection, Mistral, and others. We’ve seen meteoric rises this year by start-ups like Character.ai, who are leveraging these breakthroughs to deliver novel product experiences to end users.

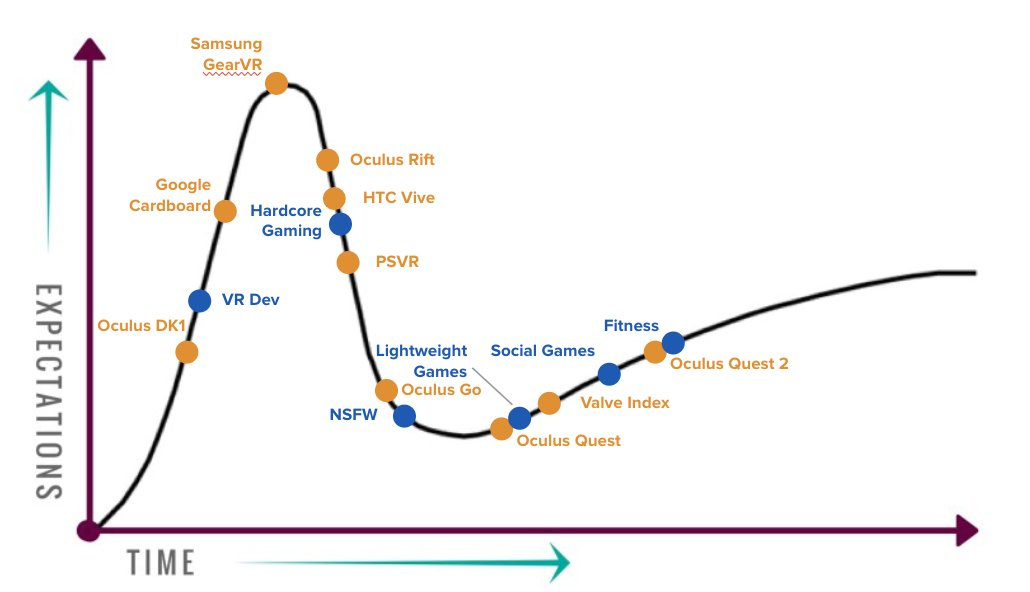

Meanwhile, Apple made its long-awaited entry into the augmentative era by announcing the Vision Pro AR/VR headset in June, right after Google and Samsung announced a joint-effort AR/VR headset, all while Meta is set to release the next-generation Quest 3 headset in late 2023, putting more powerful spatial capabilities into more consumer hands. These are big distribution tailwinds in a year where VR ecosystem monthly revenues >4x’d since 2019, monthly active users of VR presumably surpassed that of the Sony Playstation 5 (while Sony also released their PSVR2 AR/VR headset in February), and the aforementioned Roblox released on VR.

With 2023 marking foundational developments in core technologies that serve as the building blocks of the augmentative era, we believe the time to invest is now. The perfect storm of addressable consumer TAM (a la gaming), core technological innovation and infrastructure, and downstream VC backing are in place to build industry-defining companies today.

Speaking of downstream VCs…

(A closing, tangential thought: The “non-consensus” view of the augmentative era is not dissimilar to the now-commonly accepted “AI-first” view of the future— the augmentative era is just 2 degrees off-center. We believe that the paradigm shift of computing is incomplete without incorporating human spatial senses).

Who is funding the augmentative era today?

Short answer: A number of the biggest corporates and VCs.

A takeaway from the previous section, in which I attempt to lay out the idea of the self-coined “augmentative era”, is that there is no standardized language in talking about this particular vision of the future. But, big corporates and VCs are investing in it— they just each call it different things and approach it from slightly different angles. We in the space essentially communicate this vision to each other in the form of dialects.

Corporates still like referring to the augmentative era as the (now-dreaded) “metaverse”, despite it now being an obfuscated and nebulous term for many consumers. Notably, in addition to funding AI startups, Nvidia is building the augmentative era with the Omniverse, a suite of 3D-centric technologies to build the “metaverse”. However, Nvidia’s idea of metaverse differs in application from the mismarketed metaverse popularized (in meme-worthy fashion) by Meta, who is nonetheless investing billions into advancing the aforementioned core technologies (AI and AR/VR), and even offering non-dilutive funding to VR startups. Even other conglomerates like LG and HTC are investing out of corporate arms to build their own “metaverses”. Side note, for what it’s worth, Nvidia’s CEO Jenson Huang believes the “metaverse” is a bigger market opportunity than our entire existing economy.

Top-tier VCs smartly avoid leading with the out-of-favor metaverse terminology and articulate the augmentative era in more practical terms, unsurprisingly, from the lens of gaming. This makes a lot of sense given the aforediscussed onset of the augmentative era in gaming. For example, a16z launched their first $600M games fund last year, with the thesis that “games infrastructure and technologies will be key building blocks of the Metaverse” and games already resemble “social networks and scale like consumer technology companies”. Similarly, Lightspeed Venture Partners are “believers in the power of gaming as the ultimate online social experience” where consumers will flock towards “the most immersive experiences”, referencing the importance of experiences within virtual worlds in their recent announcement of their investment into Inworld.

There is a pre-seed-sized gap in VC

While corporates and top VCs like a16z and Lightspeed are investing in the augmentative era — with most gaming funds and even hyper-successful tech funds like USV also exploring strategies — they overwhelmingly invest at seed stage and later. But of course, before raising a seed or an A, companies usually raise pre-seed rounds from first-believer investors. Many generational companies that are founded today will look for pre-seed partners to help catalyze their businesses before viably soliciting investment from any tier-1 firms down the road.

There are a few phenomenal established pre-seed firms that have been investing in the augmentative era for years, and have returned LP capital in the process— for example, Boost VC and Anorak Ventures (who, for further dialect disambiguation, call the augmentative era “computing in the 3rd dimension”— Amal is more eloquent than me, and does a better job of laying it out). A few promising new firms have also popped up in the last couple of years like Founders Inc., Hartmann Capital, and FOV Ventures (Europe-focused).

Yet, there is a feeling among many investors that at pre-seed there is currently more founder potential than available VC capital. While a few great funds are deploying at pre-seed, they are almost always <$100M in fund size, meaning there is only so much deployable capital available. I also felt this first-hand as an angel investor: Almost instantly I started seeing a number of the same deals as the established funds, many of which still had open allocations; On the flip side, I saw the limits in VC capital when supporting my portfolio companies with raising more capital from co-investors. Generally speaking, the space, including downstream investors, is quite small but very high IQ.

Where there is a gap, there is an opportunity— and there is a golden opportunity to build a first-believer firm investing in the augmentative era now. We stand at the brief, extraordinary period in time where 1) there is demonstrative demand and market for VC capital and 2) there is enormous long-term upside potential in establishing a leading firm before consensus. The opportunity is so large that even traditional downstream investors firms have started programs to invest at pre-seed e.g. a16z launched its Speedrun accelerator earlier this year. We believe we are positioned to build a firm to fill the gap.

The fund: By a cockroach, for the cockroach

With Earthling, we are building a fund backing cockroaches at pre-seed building the augmentative era.

First, let’s talk about the “cockroach” — and yes, I’m totally using the legendary Boost VC’s framing here. "Cockroach” is a term of endearment describing the condition of the early-stage entrepreneur: resources are tight, headwinds all around, and everything is anything but certain and stable— but you consistently find ways to carry on and build a well-oiled company. I’ve been told by many people wiser and more successful than me that compounding consistency is the key to success— as a cockroach, you survive long enough to start compounding and once the tailwinds come, you take over the world. This is the nature of the cockroach. The earliest stages of a startup are war, and every billion-dollar founder was a cockroach at one point in their career.

As a pre-seed investor, you are primarily backing cockroaches. You are required to build conviction in the absence of significant market traction or other external validating data points (e.g. tier 1 co-investor signal).

I believe these dynamics of super early investing explain why pre-seed lacks many institutional investors. Investing in the augmentative era before any market traction is objectively difficult. The building blocks — AI, AR/VR, as well as upstream tech like robotics, sensors, and computing infrastructure — are very fast-moving, complex, and nuanced technical disciplines, contrary to what Twitter might make you believe. I spent years engineering at these intersections at the highest level, so I’m saying that from experience! Many VCs just don’t have the technical chops, creativity, or experience to evaluate teams building with these tools very early in the company life cycle.

This is how we come into play…

The GP: Domain specialist, investor, and cockroach in pursuit of asymmetric upside

I think every new manager raising a fund has an impressive professional track record, otherwise, they wouldn’t be raising a fund. Raising a fund in many ways is the culmination of career success, not the beginning.

As such, I’ll make my qualifications brief: TL;DR I’ve lived in spaces building the augmentative era for the better part of the last decade: I’m a senior machine learning engineer turned venture investor. While my academic background was in natural language processing, I spent the majority of my 4.5 years at Meta building spatial AI systems for edge hardware in Reality Labs i.e. the intersection of AI and AR/VR— the building blocks of the augmentative era. Meanwhile, though I began angel investing briefly after starting at Meta, I started exclusively investing on the augmentative era thesis in Q1 2022 (until Q2 2023, when I started the fund). I made 22 personal on-thesis investments (including leading SPVs) into the augmentative era: 11 have been marked-up, I co-invested multiple times with established pre-seed funds like Boost VC and Anorak Ventures, and have had companies raise follow-on capital from giants like a16z and Nvidia. Read: I’ve built the core technology, understand the markets, and see the same start-up landscape as significant funds in the space— I simply get the augmentative era. But am I Palmer Luckey? No.

What my CV doesn’t tell is the turbulent decade of commitment preceding Earthling.

“Cockroach” is in my DNA. I was brought to the US during elementary school as my parents, like all immigrants, wanted to pursue the American Dream. “Dream” not so much: I grew up in a single-parent household with constant financial instability which culminated with being pseudo-homeless between my college graduation and start date at Facebook (i.e. Meta) only 5 years ago. While there were good times, I do not have a fond memory of my childhood and adolescence.

There were 2 positive things I took away growing up under incessant instability: 1) I never want to live like that again and 2) no one is coming to save me, and I’m going to have to make epic sh*t happen myself. Under that pretense, I became pretty hardcore with persisting on opportunities that I believed could change the world (or my world, at least)— going all-in on asymmetric or non-consensus convictions (and being right) is the only chance to win big when starting from 0. As a builder, I went all in on starting a company in 2013— it failed but the work led me to stumble upon AI. I went all in on AI in 2015— that landed me my first and first and only “real” job at Facebook. I went all in on VR in 2019 on my first day at Facebook— that landed me all the VC and corporate relationships to turbo-charge my angel investing. Then, I went all-in on angel investing in the augmentative era— in addition to financial upside in promising companies, that landed me the opportunity to start this fund. It’s not much, but it’s honest work: consistent compounding, nature of the cockroach.

Earthling feels like a culmination of my life’s work up to this point, and specifically a natural continuation and institutionalization of my angel investing; Despite angel investing all of my disposable income, it was simply not enough capital to capture all the upside present in the market. Investing at fund scale is the asymmetric, non-consensus opportunity to index across the most early-but-talented teams in the world (i.e. cockroaches) building a future that I’ve been building toward for years.

Within the context of my journey, Earthling is a pure play to win. With Fund I being quite small, mediocre fund performance while getting rich from management fees is not an option (and fees will net me only a fraction of the salary I just left behind). Since the distribution of venture capital fund performance is subject to the power law, being at least a top decile fund is the only path to victory. Anything less, frankly, makes no material difference to my trajectory (or to our LPs). I’m starting this fund since I have a firm belief that we are positioned to deliver top decile performance— the market opportunity is big enough, we just need to execute on our existing positioning as an early market leader.

How we invest

Pre-seed is not overly complicated: Invest in extraordinary teams doing important things.

“Extraordinary” can come in many forms in the absence of tangible market traction. For our investments, I look to build conviction in some combination of the following characteristics:

Top decile speed of execution. Teams that get sh*t done quickly tend to win.

Resourcefulness. They can do a lot with little— they embrace being cockroaches. They’ll find ways to survive through bear markets and VC winters and thrive with tailwinds in bull markets.

A “secret” or unique insight they have about the problem space that they are building their company around. As Peter Thiel says, the greatest entrepreneurs “built their businesses on unique ideas”.

“Important things”, for us, mean market-viable sectors propelling the augmentative era (as previously discussed). Our favorite businesses within these parameters find the fine line between market-viable and completely crazy:

Gaming e.g. studios, gaming infra, social. Gaming is currently at the forefront of the augmentative era, and much of the gaming infrastructure being built today will serve as foundational rails of the broader augmentative era.

Consumer e.g. fitness, edtech, wellness. Novel, previously impossible consumer experiences enabled in the augmentative era.

Infrastructure e.g. data, robotics, dev tools. Upstream technologies that are needed to drive building block innovations. In simple terms, the core technology needed to build “novel, previously impossible consumer experiences”.

Importantly, we don’t just invest in nominal pre-seed rounds. For the fund math to make sense, we are valuation strict and typically do not invest in post-money valuations greater than $8M, and draw a hard line at $12M. We aim to have a median entry price of ~$5M post across the fund. Playing the numbers game empirically drives better returns for pre-seed and seed funds since it increases the chance of hitting an extreme outlier— logically, to be able to hit an extremely outlier your entry price needs to give you upward room for potential fund returning multiple expansion, net of dilution.

How we win

As a small check pre-seed VC, we maximize our chances for success at this stage by meeting the best teams, winning an allocation, and catalyzing our teams to secure follow-on capital from downstream investors.

Top-tier industry networks. VC is a people business. From years as an operator and angel investor in the space, I’ve built deep relationships across the industry with top co-investing and downstream VCs, leading founders, and corporates, while our LPs include GPs from some of the most resilient venture firms in the world that are investing in the augmentative era. These relationships drive top-end deal flow to us, while also giving us strong levers to secure follow-on investments for our portfolio founders.

We’re magnetic to extraordinary teams building the augmentative era. Teams building the augmentative era are working on technically complex problems. Bringing deep experiences from years of engineering in the same technical domains, we are one of the very few institutional investors with the in-house know-how to cut through the noise and build early team conviction. Industry founders love working with early investors that “get it”. This gives us unique wins e.g. I was the only angel investor able to win allocation in ShapesXR, the leading spatially-native design platform (which just announced its $8.6M seed round).

We go to war for every deployed dollar. Reminder: We play to win— and we understand the value of our deployed dollar. For us, winning means helping our founders establish early benchmarks that keep them hotly on a venture-scale trajectory, culminating with securing follow-on capital from larger investors within 18-24 months (or less) of our investment i.e. raising a seed round. Even hyper-talented technical teams we identify early often need proper support and guidance navigating the venture landscape. It’s our job to help them unshackle their true potential in the market. Leveraging our technical chops, deep insights into the market, and networks of investors and operators, we pull all the stops to ensure success for our portfolio in raising additional capital. We work extremely closely with founders on anything to ensure we hit our benchmarks: narrative/pitching, metrics, monitoring, reducing burn rates, etc. Founders are our clients, and our success is completely correlated with their success— so we unconditionally go the extra mile. In the last 12 months, I’ve helped 11 of my young companies that have gone out for additional capital raise >$40M, including from top industry investors like a16z, Nvidia, Boost VC, Anorak Ventures, and many more.

Earthling is a newly active fund and we’ve made a handful of investments at the time of writing. Beyond Fund I, I’m constantly thinking about the growth and future of Earthling which I will cover over time in this Substack. For now, I wanted to lay out the what, how, and why of Earthling Fund I— hopefully, it presents a thought framework to other potential new managers thinking about taking the plunge into fund management!

![OTD] 30 years ago, Ayrton Senna (left) and Alain Prost (right) collided into turn 1 at Suzuka, crowning Senna 1990 WDC (his second title). Picture taken seconds before impact. The crash came OTD] 30 years ago, Ayrton Senna (left) and Alain Prost (right) collided into turn 1 at Suzuka, crowning Senna 1990 WDC (his second title). Picture taken seconds before impact. The crash came](https://substackcdn.com/image/fetch/$s_!8x4h!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F920e9a91-2dbb-4c03-8f2b-fc14f3b99beb_1280x853.jpeg)